our differentiators

akompani SA, founded in 2017, is an independent consulting firm dedicated to owners of SMEs.

Our core business is to assist in the succession or acquisition of businesses.

from entrepreneurs to entrepreneurs

All members of our team have founded and managed one or more SMEs during their professional careers.

Multisectoral expertise

akompani combines a unique blend of energy, talent and versatility. Our team of advisors has a wide range of backgrounds, including swiss-made manufacturing, international distribution, finance, medtech, telecom and the digital economy.

they rely on us:

Private banks, audit firms, tax specialists and business lawyers approach akompani to provide their clients and business owners specific M&A services.

approach

Our advice is concrete and pragmatic. We advise you across all stages of a transaction.

our services

Our expertise is renowned in strategy, corporate finance, business intelligence and negotiation.

strategic advisory

Definition and implementation of a strategy, reorganisations, implementation of performance management and optimization tools.

M&A

Selling a business, is multifaceted and highly complex. akompani's rigorous and personalized methodology helps to avoid many pitfalls.

financial advisory

Every business needs a sustainable, long-term financial strategy. We have extensive experience in planning and implementing effective finance strategies.

credentials

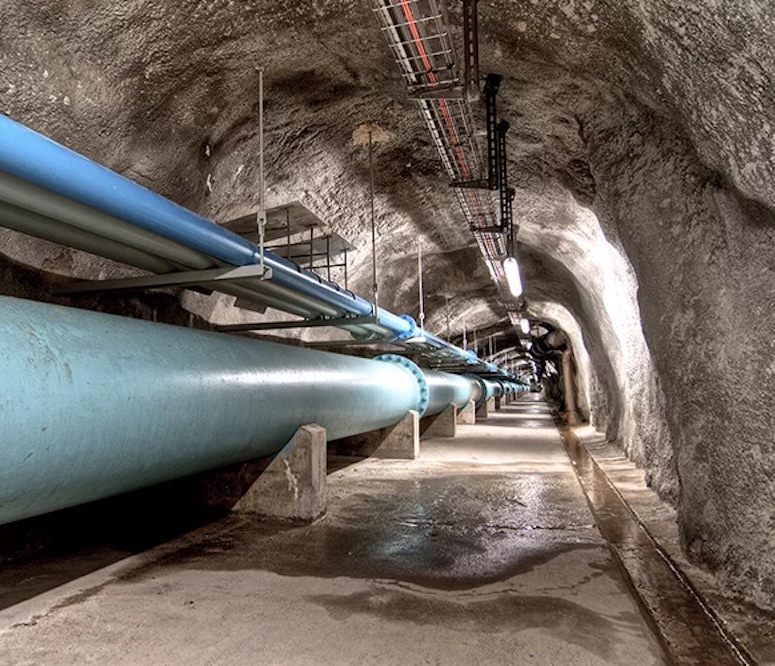

We are active across various economic sectors.

Advisory of the sale of DLK Technologies SA to the Envirochemie Group, providing a sustainable solution for the succession of the family business.

Advisory on sale of Holfitec Group to TELTEC GmbH, creating Europe's largest independent distributor of semiconductor equipment.

Advisory in strategy, market positioning, pricing and intellectual property (patents, trademarks, design).

Sucession advisory on sale to a Swiss investor. CFO ad interim and recruitment support.

Support for the sale of 100% of the share capital, including the preparation of a business plan and a valuation.

Advisory on governance for a group active in 7 strategic fields. (Land use planning, Water, Energy, Geology,...).

Advisory on selling a minority share of the capital of an international industrial group. Introduction of investors on a global scale.

Supporting the entire transaction process, from the initial discussions to the closing of the acquisition by BontexGeo Group.

Development of a "mid-stream oil infrastructure" acquisition plan for an international group.

Advisory on governance and financial management. Recruitment of an interim CEO, sale of a strategic participation for several MCHF.

Creation of a business plan and information memorandum, identification of potential buyers and negotiation support.

our entrepreneurial journey

Some examples of companies founded by our team members.

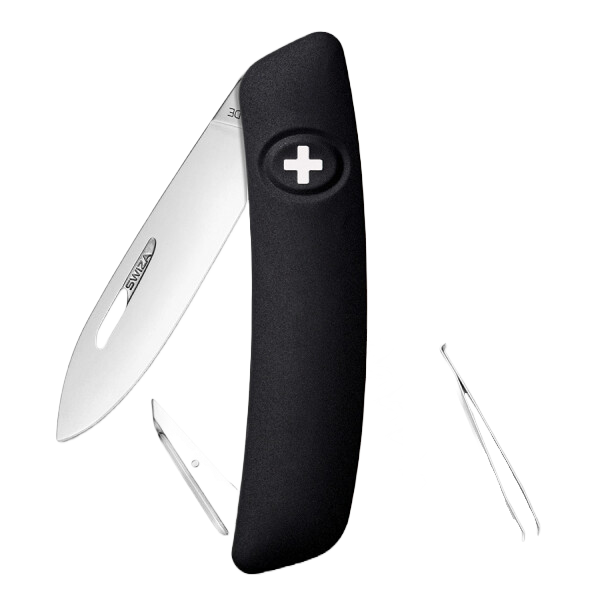

Helvetica Brands SA (SWIZA®)

Innovative Swiss made sknives and commercialisation of derivative products under the brand SWIZA.

Premium sknives and products

Tweaq Limited

Development and commercialisation of innovative solutions in the hygiene and safety industry.

Hygiene and connectivity

Intiyo Sàrl

Innovation in the solar energy sector, enabling the monitoring of soiling levels and degradation of photovoltaic systems.

Renewable energies

contact us

The offices

Lausanne (Rue du Petit-Chêne) et Porrentruy (Rue du Creugenat)

Phone

+41 32 467 11 11